Construction Materials Industry Prosperity Index (MPI) for May 2024 - Construction Materials Industry Running Stably in May

Construction Materials Industry Prosperity Index (MPI) for May 2024 - Construction Materials Industry Running Stably in May

First. Construction Materials Industry Prosperity Index in May.

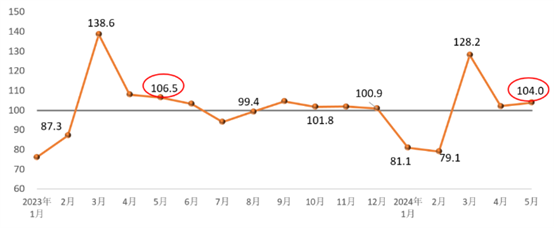

May 2024, building materials industry boom index for 104.0 points, compared with April rebounded 1.9 points, higher than the critical point, in the boom area, but the overall performance is still weaker than the same period last year. May boom index shows that the building materials industry to maintain a stable response to the trend, but still weak operation.

On the supply side, in May, the price index for the construction materials industry was below the critical point and the production index was above the critical point. Among them, the price index of building materials industry 99.9 points, 0.1 points higher than last month, basically flat; the production index of building materials industry 104.1 points, 1.9 points higher than last month. Overall, the price of building materials products is still low fluctuations; building materials production activity has improved over the previous month.

On the demand side, building materials investment demand index, industrial consumption index, international trade index are higher than the critical point, industrial consumption index rebounded to above the critical point, play a positive pulling effect. Among them, building materials investment demand index 104.0 points, 1.0 points than last month, the construction market demand has increased, but the degree of recovery is not as good as the same period last year; building materials products industrial consumption index 104.6 points, 6.4 points than last month, the application of building materials products related to the demand for manufacturing industry is good; building materials international trade index 101.2 points, 6.4 points than last month, the building materials commodities trade to maintain a stable, pulling role has slowed down. Stable, pulling role has slowed down.

Overall, the demand for building materials market in May is still recovering, but the speed of recovery is not as expected.

Second, MPI influencing factors analysis and early warning.

The overall market demand for building materials industry to maintain the recovery trend.

With the national major projects and many key projects to start construction, infrastructure demand for building materials products signs of recovery, transportation, water conservancy and other areas of investment growth of more than 10%, but real estate investment fell significantly, market demand is still uncertain. Expected solar cells, automobiles, rolling stock, air conditioners and other household appliances, cell phones, integrated circuits and other products will maintain steady growth in output, supporting the demand for related building materials products. International trade in building materials remains stable. The above factors generally support the recovery of demand for building materials, promoting a slight rebound in the building materials industry boom index.

Product prices adjusted to a low level. in May, in the building materials industry, wall materials, thermal insulation materials, lime gypsum, construction stone, building technology glass, mineral fibers and composite materials, such as six industry product prices rose, the number of price increases in the industry than in April increased by 3, but most of the building materials product prices are still running low. Overall, building materials product prices are still in a low adjustment stage, rising power is still insufficient.

Building materials industry is still facing volatility factors. in May, most of the building materials industry production index is in the boom zone, enterprise production than last month to speed up, capacity supply to maintain growth, strong supply, weak demand characteristics will continue, product prices are under pressure. Climatic and other factors in the second quarter of the construction market activity as well as coal, natural gas and other factors of production supply and demand will increase, the market recovery, energy costs have an impact. In addition, the differences in market characteristics and business strategies of different regions and industries will be further evident, increasing the volatile influencing factors of industry operation.

Notes:

1. Construction Materials Industry Prosperity Index (MPI) mainly monitors the operation trend of the construction materials industry, with strong prediction and early warning effect. when the MPI is higher than 100, it indicates that the operation of the construction materials industry is in the prosperous range, and when the MPI is lower than 100, it indicates that the operation of the construction materials industry is in the non-prosperous range.

2. Construction Materials Industry Prosperity Index (MPI) judges the operation trend of construction materials industry from the supply side and demand side. The supply side is divided into price index and production index, and the demand side is divided into investment demand index, industrial consumption index and international trade index of building materials according to the actual impact of the demand field on the building materials industry.

3. The price index of the building materials industry reflects the trend of changes in factory prices of the building materials industry. The ex-factory price does not include the costs incurred in the circulation process of building material products, product profits and taxes. The factory price is different from the market price, the two changes will affect each other, there is a time lag, in a certain period of time there may be inconsistent trend of change.

4. the index of industrial production of construction materials, reflecting the trend of industrial production of construction materials, excluding price changes.

5. investment demand index, reflecting the trend of changes in investment market demand related to construction materials.

6. industrial consumption index reflects the trend of industrial consumption demand related to construction materials. Industrial consumption, including both inter-industry consumption within the construction materials industry and downstream industry consumption of construction materials products.

7. International trade index of building materials reflects the change trend of international trade of building materials, which is mainly composed of export index of building sanitary ceramics, building technical glass, building stone, glass fiber and composite materials, non-metallic minerals and other industries.